Masuzi December 12 2018 Uncategorized Leave a comment 21 Views. Tax Relief Year 2018.

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Change In Accounting Period.

. Calculations RM Rate TaxRM A. Malaysia income tax rate 2017. 1 Corporate Income Tax 11 General Information Corporate Income Tax.

Income tax rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. On the First 5000 Next 15000. Whats people lookup in this blog.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Individual Income Tax In Malaysia For Expatriates Offs News Flash. Top Earners In Western Europe Hit With Bigger Tax Bills Than Their Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets.

Corporate tax rates for companies resident in Malaysia is 24. The most up to date rates available for resident taxpayers in Malaysia are as follows. Spouse and children relieves introduced.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. For more details check out our detail section. Income Tax Rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some.

The amount of tax relief 2018 is determined according to governments graduated scale. Lessmaximum annual remuneration in tables 12400000 Difference 8360000 Tax payable on maximum annual remuneration in tables 2590000 Addtax payable on difference 8360000 x 35 2926000 Total tax payable 5516000 Divide annual tax - 5516000 by 12 the number of monthly pay periods in the year Deduct each month - 459667. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. See also Evenflo Register Car Seat Canada.

Basis Period for Company. Other rates are applicable to. 2121 Malaysian Tax Booklet Income Tax.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. There are a total of 11 different tax rates depending on your earnings so figuring out what you owe can be complicated. Year Assessment 2017 - 2018.

How many income tax brackets are there in Malaysia. Malaysia Income Tax Rate 2018 Table. Table of Contents 20182019 Malaysian Tax Booklet 5.

Malaysia personal income tax guide 2019 malaysia personal income tax rates malaysia personal income tax guide 2018 malaysia income tax guide 2017. Table of Contents 20182019 Malaysian Tax Booklet 5. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

Calculations RM Rate TaxRM 0 - 5000. The page is not found. Assessment Year 2018-2019 Chargeable Income.

Read our comprehensive tax guides for info and savings tips before your next visit to LHDN e-filling. This income tax calculator can help estimate your average income tax rate and your salary after tax. What is tax rate in malaysia taxplanning budget 2018 wish list what is the income tax rate in malaysia individual income tax in.

Individual income tax in malaysia for audit tax accountancy in johor bahru rates irs announces 2018 tax brackets. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. 2121 Malaysian Tax Booklet Income Tax.

Start e-filing for personal income in 2017 with our easy-to-use calculator to find out your tax deductions relief and total rebates. On the First 5000. Tax tables in Malaysia are simply a list of the relevent tax rates fixed amounts and or.

The income tax system in Malaysia has 12 different tax brackets. Inheritance Tax Rates In G7 And Eu Countries Ten Times Higher Than. On the First 5000.

Inland Revenue Board of Malaysia shall not be liable for any loss or. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

This page provides detail of the Federal Tax Tables for 2018 has links to historic Federal Tax Tables which are used within the 2018 Federal Tax Calculator and has supporting links to each set of state. Masuzi December 14 2018 Uncategorized Leave a comment 15 Views. Tax Rate Tables 2018 Malaysia.

Income Tax Table 2018 Malaysia. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. Best Income Tax calculator in Malaysia.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Malaysia Personal Income Tax Rate. Amending the Income Tax Return Form.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00 Allowance Bonus0000 - Allowance Bonus.

8 Mac 2021 Commercial Marketing D I D

4 Dec 2018 Investing Activities Financial

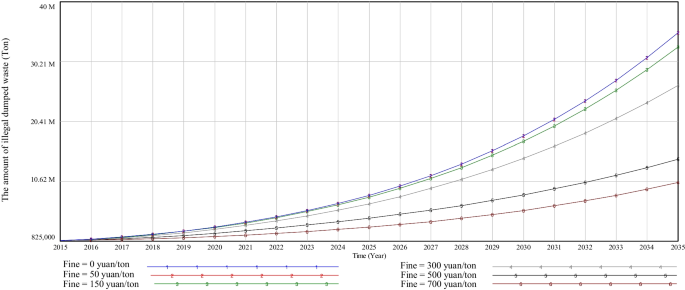

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

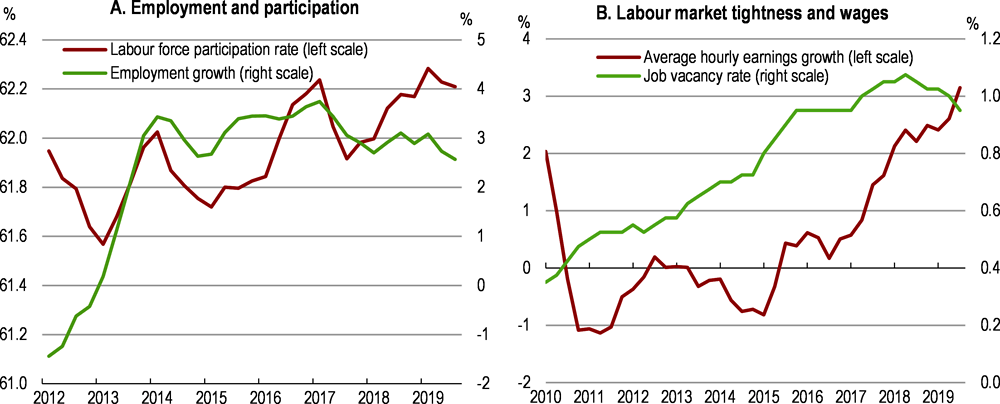

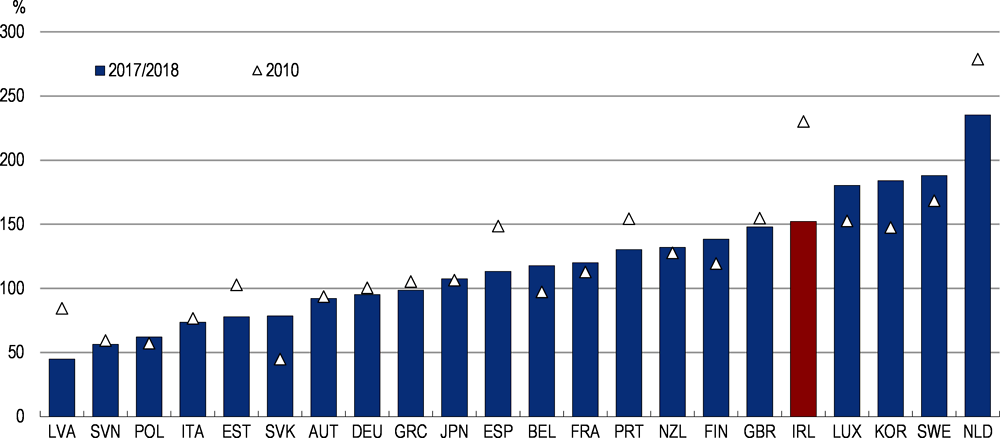

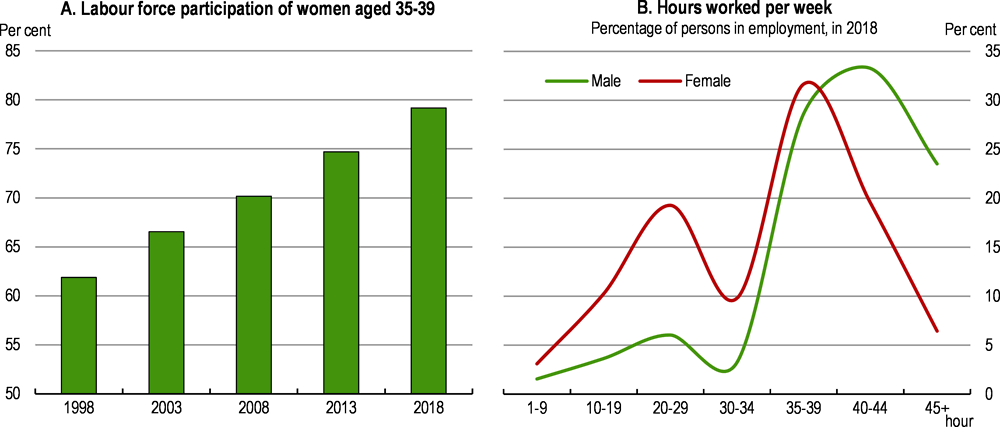

Key Policy Insights Oecd Economic Surveys Ireland 2020 Oecd Ilibrary

21 Sept 2020 Forced Labor Infographic Crude

Key Policy Insights Oecd Economic Surveys Ireland 2020 Oecd Ilibrary

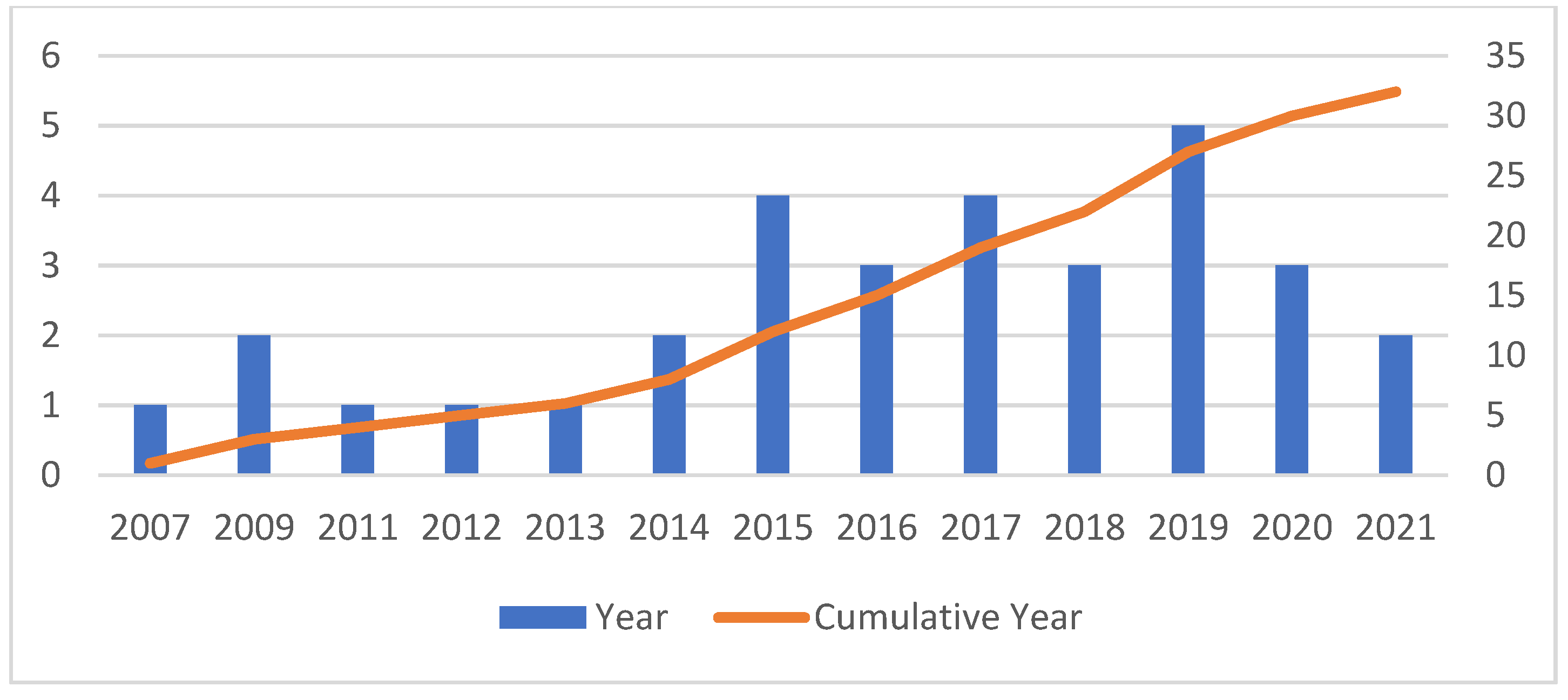

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

Sustainability Free Full Text Motivations And Future Intentions In Sport Event Volunteering A Systematic Review Html

Roulette Table Layout Wheel Diagrams And Numbers Roulette Table Roulette Wheel Roulette

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

Pin On Datesheets Notifications

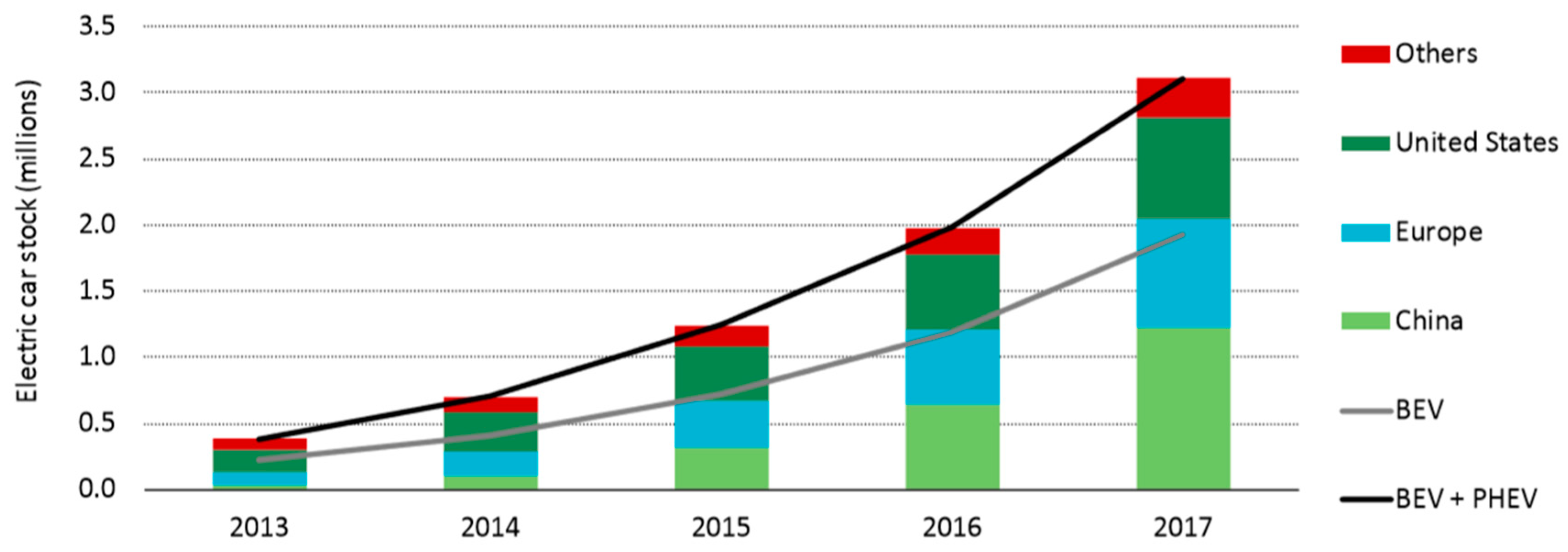

Sustainability Free Full Text Key Factors Influencing Consumers Purchase Of Electric Vehicles Html

1 Key Policy Insights Oecd Economic Surveys Romania 2022 Oecd Ilibrary

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

1 Key Policy Insights Oecd Economic Surveys Romania 2022 Oecd Ilibrary

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

Promoting Construction And Demolition Waste Recycling By Using Incentive Policies In China Springerlink

2018 Public Holidays In Malaysia School Holiday Programs Tuition Centre School Holidays

Key Policy Insights Oecd Economic Surveys Ireland 2020 Oecd Ilibrary